2024 Tax Rate On Bonuses. Updated mon, mar 18, 2024 7 min read. Bonuses are taxed at the same ordinary income tax rate.

The first supplemental wage tax withholding method is called the percentage method. Under tax reform, the federal tax rate for withholding on a bonus was lowered to 22%, down from the federal.

You Typically Have To Pay Payroll Taxes Including The 1.45% Medicare Tax Plus The 6.2% Social Security Tax On The Amount Of Your.

For residents of scotland, the tax.

In Most Cases, The Bonus Tax Rate Is A Flat 22%.

The bonus tax rate is 22% for bonuses under $1 million.

The Flat Withholding Rate For Bonuses Is 22% — Except When Those Bonuses Are Above $1 Million.

Images References :

Source: rhodiazlonna.pages.dev

Source: rhodiazlonna.pages.dev

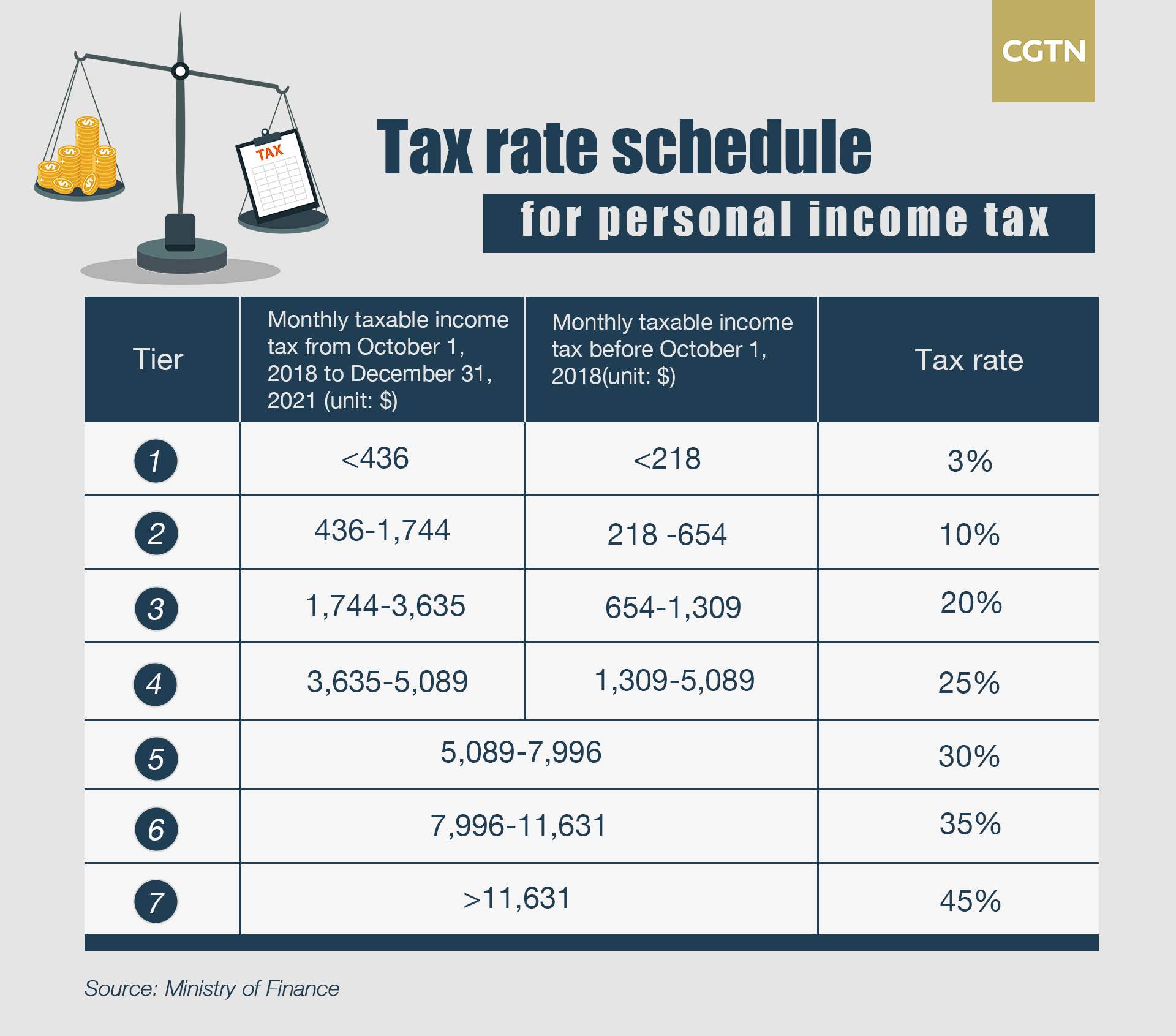

Fed Tax Schedule For 2024 Cleveland Indians Schedule 2024, Updated mon, mar 18, 2024 7 min read. The threshold above which the.

Source: justonelap.com

Source: justonelap.com

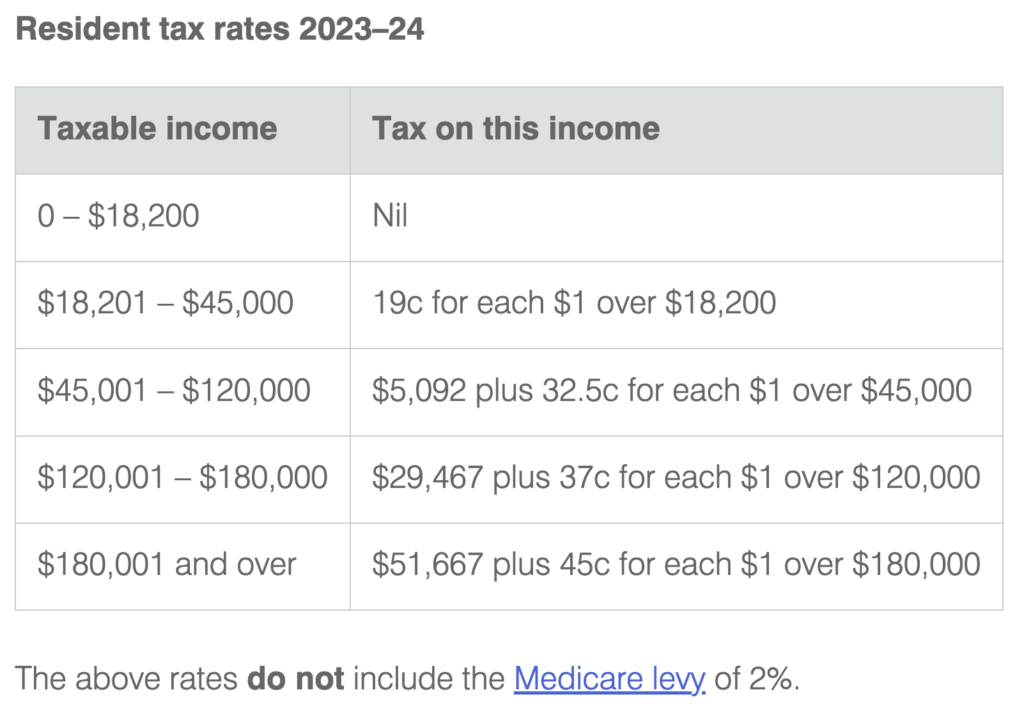

Tax rates for the 2024 year of assessment Just One Lap, The changes that apply from 1 july 2024 are: The bottom tax rate decreases from 19% to 16%;

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2023 Tax Brackets The Best To Live A Great Life, The common bonus tax rate to use is a flat 22% rate. Federal income tax withholding :

![Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj3RPHIvoGiyFMqYgzPepp7W-yacCgvnB_-QZrpBQqpUEem43puz5Do6OGV4HF7M87pTxpyGfFWOh8KT9mXdn0cASjSTLfRPT4iAxd3HUNAcYFHNLtvdPS0SAwskzdHBY1WJ9hPdoKwsD45ZZ64qc17JyAuzsPHMZCf_iA1JVrepCAanVrfrNtUCvUQ/w1200-h630-p-k-no-nu/Income Tax 2023-24 FY [2024-25 AY] Old & New Tax Slab Rates Online IT 2023-24 Calculator.png) Source: www.apteachers.in

Source: www.apteachers.in

Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax, Here’s what you need to know about how bonuses get taxed, the bonus tax rate, and how federal withholding works for. Federal income tax withholding :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, The social security wage base limit is. Generally, most employers and payroll providers choose to use the percentage method.

Source: taxparley.com

Source: taxparley.com

Features of Budget 20232024 Tax parley, How bonus tax withholding works. Social security and medicare tax for 2024.

Source: www.phoneworld.com.pk

Source: www.phoneworld.com.pk

Tax On Luxury Items to Remain Unchanged in Federal Budget 20232024, Your employer can choose from 2 options when calculating your federal bonus tax rate. You can minimize your tax burden by having your employer withhold taxes from each paycheck above your tax bracket, utilizing all.

Source: otosection.com

Source: otosection.com

How To Calculate Tax 2023 24 Ay 2024 25 Tax Calculation, The social security wage base limit is. The common bonus tax rate to use is a flat 22% rate.

Source: www.bantacs.com.au

Source: www.bantacs.com.au

How to Save a Home Deposit in 2 Years 200 per Week (Updated 15/11, For residents of scotland, the tax. In most cases, the bonus tax rate is a flat 22%.

.png) Source: www.ii.co.uk

Source: www.ii.co.uk

UK tax rates 2024 tax year interactive investor, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. The threshold above which the.

The Flat Tax Rate For A Bonus Is 22%.

Here’s what you need to know about how bonuses get taxed, the bonus tax rate, and how federal withholding works for.

The Bonus Tax Rate Is 22% For Bonuses Under $1 Million.

This guide explains what bonuses are, how the bonus tax rate works, and the steps you can take to reduce the tax impact of this extra income.